how long does coverage normally remain on a limited-pay life policy

1 crore under plan option Life with monthly mode of payment and coverage option as level. Level term policy whole life policy.

Life Insurance Buy Life Insurance Policy Plans In India Pnb Metlife

What kind of policy is needed.

. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. Premium payments made until death of insured or age 100 maturity of policy. 485 mentioned is exclusive of goods and service tax and is an example for a healthy 20 year old male non-smoker covered for Rs.

B Whole life policy with premiums paid up after 20 years. How long does the coverage normally remain on a limited-pay life policy. Modified whole life 5.

It depends on the performance of the underlying investment account b. How long does protection normally extend to under a limited pay whole life policy. When premiums are no longer required as stated in the contract c.

The policy term and premium payment term considered is 30 years. Limited pay whole life 3. Age 65 age 100 when premium payments stop at the discretion of the insurer.

Because whole life policies are guaranteed to remain in force as long as the required premiums are paid the premiums are typically much higher than those of term life insurance where the premium is fixed only for a limited term. This is basic whole life insurance with a level face amount and fixed premiums payable over the insureds entire life. Single-premium whole life 4.

Until age 65 d. Which of these would be the best example of a limited pay life insurance policy. The insured party normally pays premiums until death.

A Whole life policy that pays out its cash value over a 20 year period B Whole life policy with premiums paid up after 20 years C Term life policy that returns cash value after 20 years D Term life policy with premiums paid up after 20 years. Until age 100 Until age 100 Peter age 50 surrenders his modified endowment contract MEC. This is whole life insurance where the insured is covered.

The premium of Rs. How is the gain treated in terms of. Depending on the contract other events such as terminal illness or critical illness can.

Actual premium rates may vary and will depend on the. F needs life insurance that provides coverage for only a limited amount of time with a death benefit that changes regularly according to a schedule. Whole life premiums are fixed based on the age of issue and usually do not increase with age.

Graded whole life Straight life.

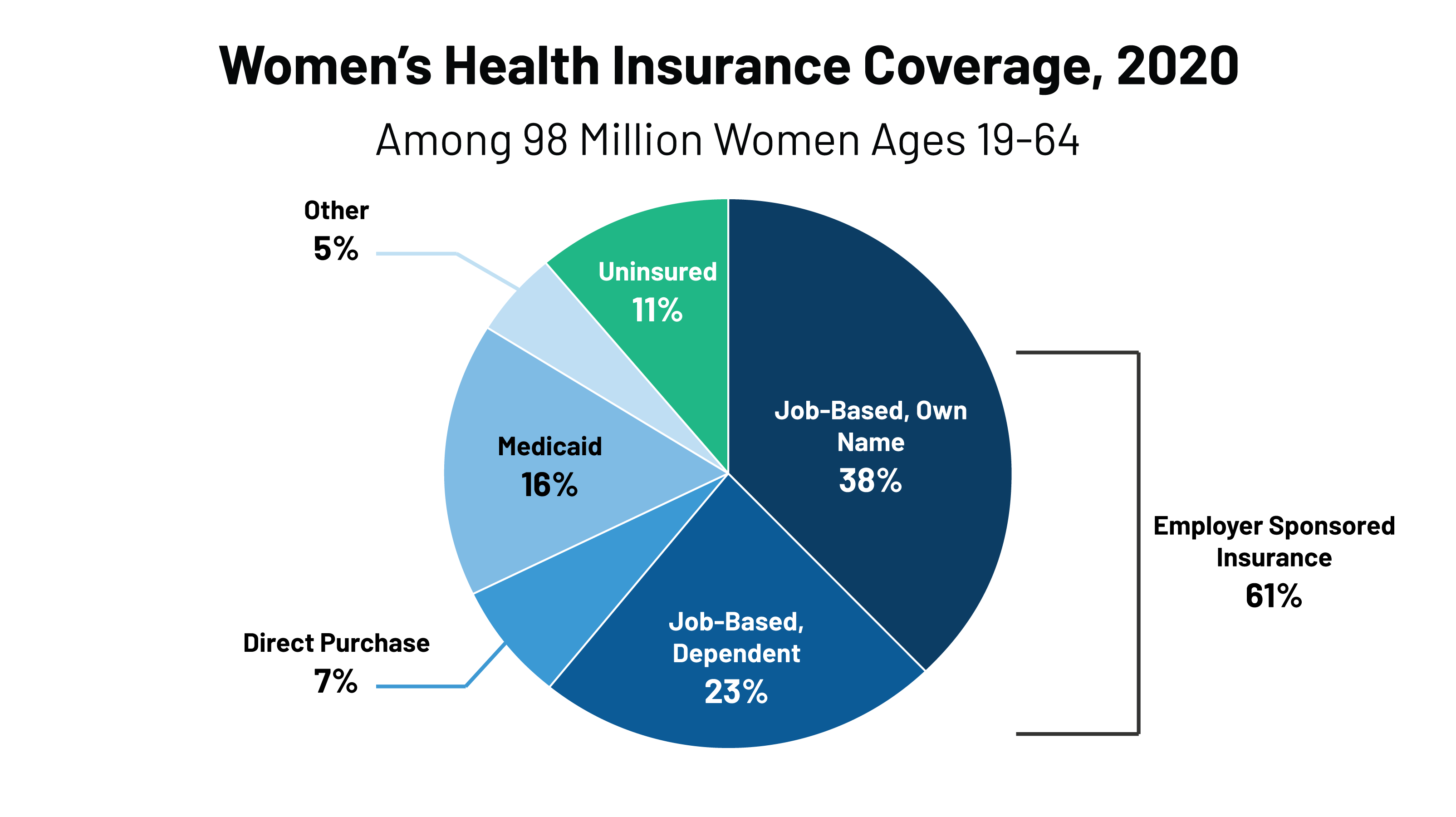

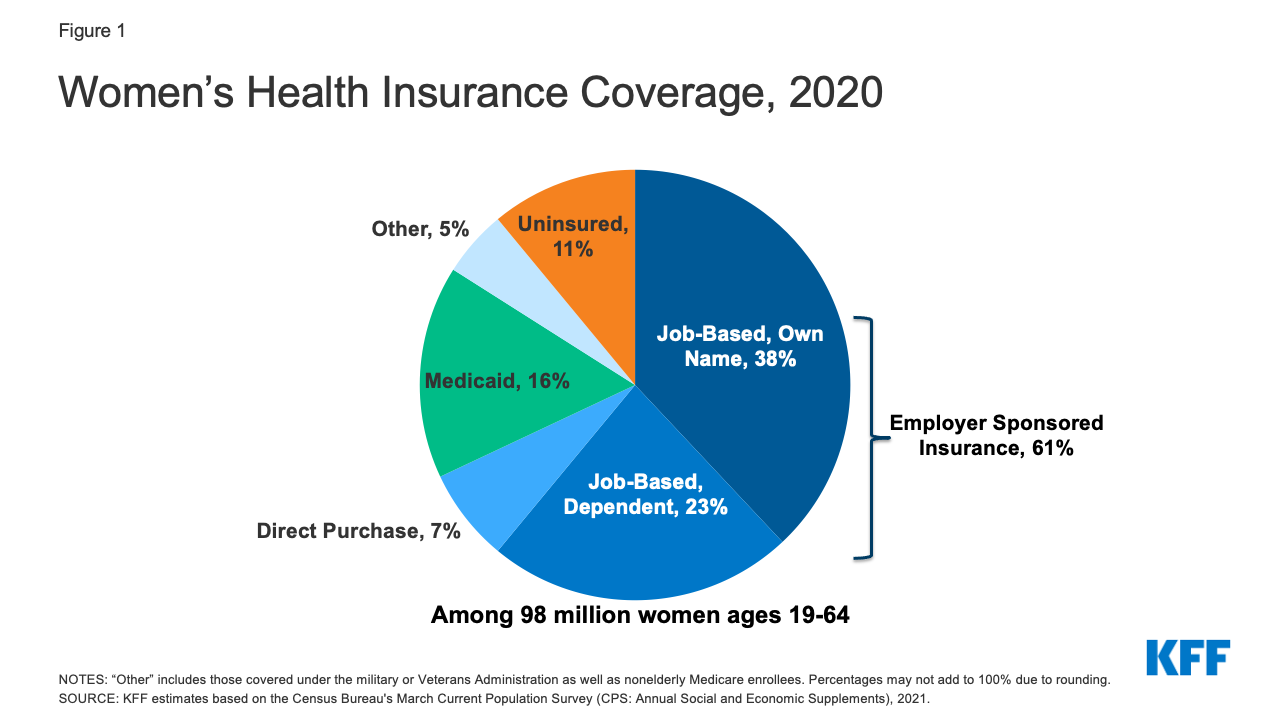

Women S Health Insurance Coverage Kff

Chapter 4 Life Insurance Flashcards Quizlet

Types Of Life Insurance Explained Guardian

What Is Sum Assured Max Life Insurance